2026 Freight Trends Report

Trending

Top Posts

Elevate your freight strategy with the Breakthrough Ecosystem. Stay informed with the latest freight index and market update, empowering you to navigate shifts in demand and capacity.

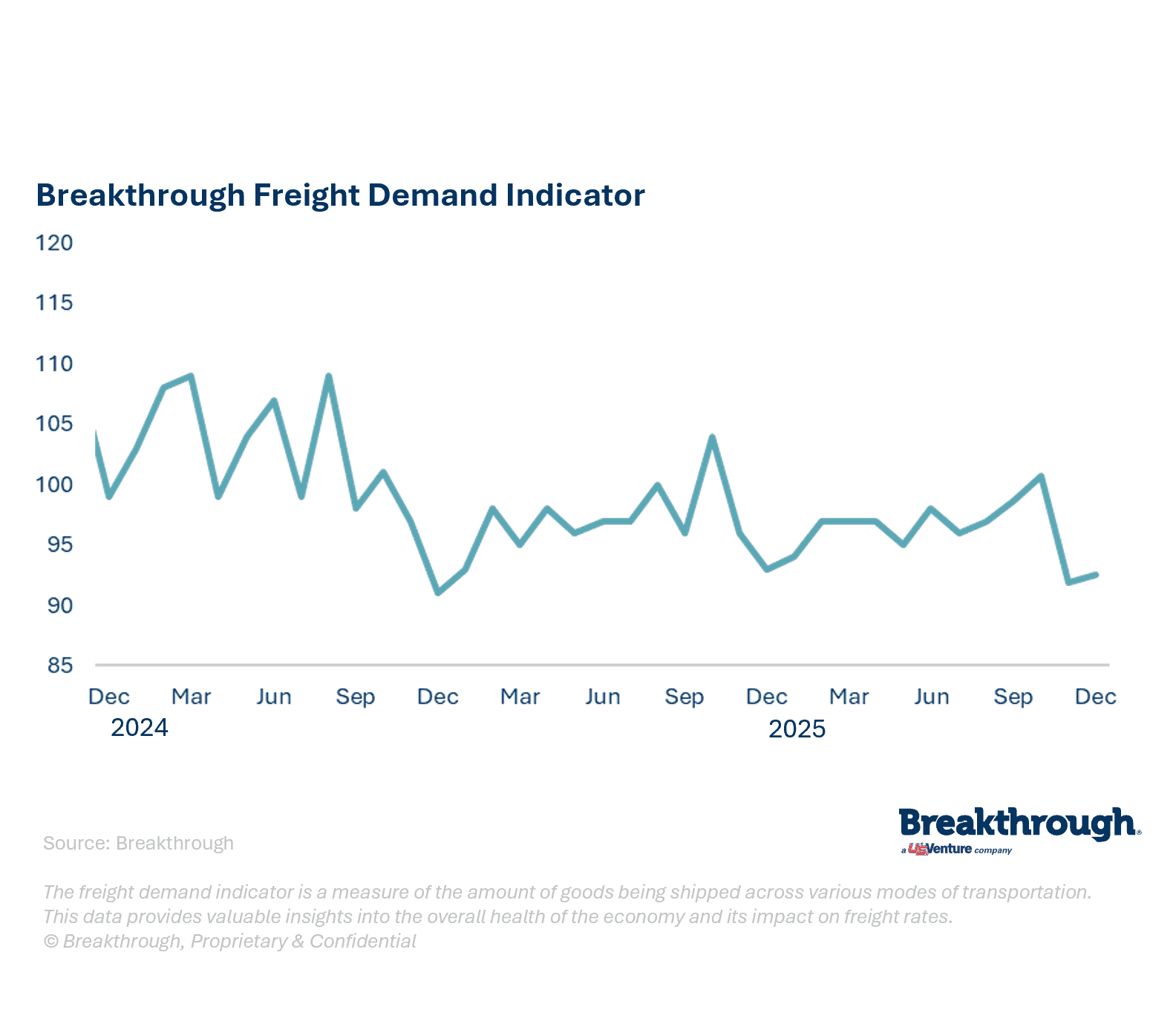

Freight demand remains muted as the Breakthrough Freight Demand Indicator continues to show soft activity across the market. After elevated volumes in 2022 and 2023, the past two years have brought steady cooling. A small uptick followed November’s decline, but overall levels are still below last year.

Looking ahead to 2026, the index points to a typical early‑year rebound similar to 2025, although broader demand is expected to stay soft. Key sectors including manufacturing, housing, and consumer spending show limited momentum early in the year. Modest improvement is expected in the second half of 2026 as economic stability increases. Even so, gains remain limited with only a 1.2 percent increase over 2025. Overall, freight demand is projected to stay weak with only marginal growth ahead in the near term.

Published: January 23, 2026

Freight demand volume data shows soft demand driven by broader economic pressures. December volumes fell 2.9 percent, the largest drop of 2025. Food and beverage, retail, and CPG weakened overall performance, while paper and packaging held steady. Consumer spending remains k-shaped, with budget pressures and policy changes weighing on demand. Housing is subdued, manufacturing shows little improvement, and freight demand remains soft entering 2026. Carrier costs, regulatory shifts, and financial strain add pressure on the supply, while tightening capacity and modest rate increases shape the outlook.

To maintain a competitive advantage, integrate innovative strategies that leverage data, technology, and market expertise. By doing so, you can take a proactive approach to procurement.

Prepare for the forecasted increase in freight demand by having access to a real-time, shipper-transacted dataset. With this type of data at your fingertips, you can benchmark your network against other industry-leading shippers and uncover opportunities within your transportation network.

Invest in mutually beneficial relationships with carriers to be prepared for any sudden changes in freight demand or capacity. Leverage Capac-ID to determine if alternative carriers might be a better match for certain lanes and loads.

Keep informed about market shifts to adjust your transportation plans promptly. By leveraging unbiased market expertise from sources like Breakthrough, you can effectively communicate market dynamics to your C-suite, enhancing your credibility as a transportation leader.

The Breakthrough Ecosystem is one of the cleanest and most robust sets of transportation data in the U.S.

Experience firsthand how Breakthrough’s innovative freight solutions can keep a constant pulse on your transportation network performance and identify areas for cost reduction and efficiency gains.