9 min read

March 6, 2026

Why Natural Gas Is a Top Alternative Fuel in Transportation

Learn why natural gas, including CNG, LNG, and RNG, is a leading alternative to diesel and offers benefits like cost stability and lower emissions.

Read moreFuel reimbursement solutions for North America, Europe, and marine.

Competitive solutions to improve your freight operations.

Comprehensive and efficient transportation RFP services.

Customized fleet management solutions for cost and emissions control.

A tailored risk management solution for shippers.

End-to-end transportation emissions management.

5 min read

January 22, 2026

Share:

Table of contents

Browse the table of contents to jump straight to the part you’re looking for

As a shipper, are you prepared for the next shift in the freight market? Understanding the factors that remove capacity from the road is critical for strategic planning. By analyzing recent enforcement data around English Language Proficiency (ELP) regulations, we can gain a clearer picture of emerging capacity constraints and how they will influence the freight market in 2026.

Leveraging Breakthrough's dataset—one of the industry’s cleanest and most robust sources of shipper-transacted data—our analysis provides data-driven insights into how regulatory changes are already tightening the market and where they will continue to go to optimize your transportation strategy.

Significant Capacity Reduction: More stringent enforcement of English Language Proficiency regulations in the second half of 2025 resulted in approximately 10,000 drivers being taken out of service.

Historical Parallels: The capacity tightening experienced in late 2025 is comparable to the market dynamics of the second half of 2019, just before the major disruptions of the pandemic.

2026 Market Outlook: Based on this reduction in driver supply, we expect to see gradual freight market tightness and modest upward pressure on linehaul rates as 2026 progresses.

The Federal Motor Carrier Safety Administration (FMCSA) requires all commercial drivers in the U.S. to read and speak English well enough to converse with the public, understand traffic signs, respond to official inquiries, and make entries on reports and records.

Following the executive order being signed in April 2025, the data shows a significant ramp-up in the enforcement of this English Language Proficiency standard. This order is having a direct and measurable impact on capacity in certain geographies.

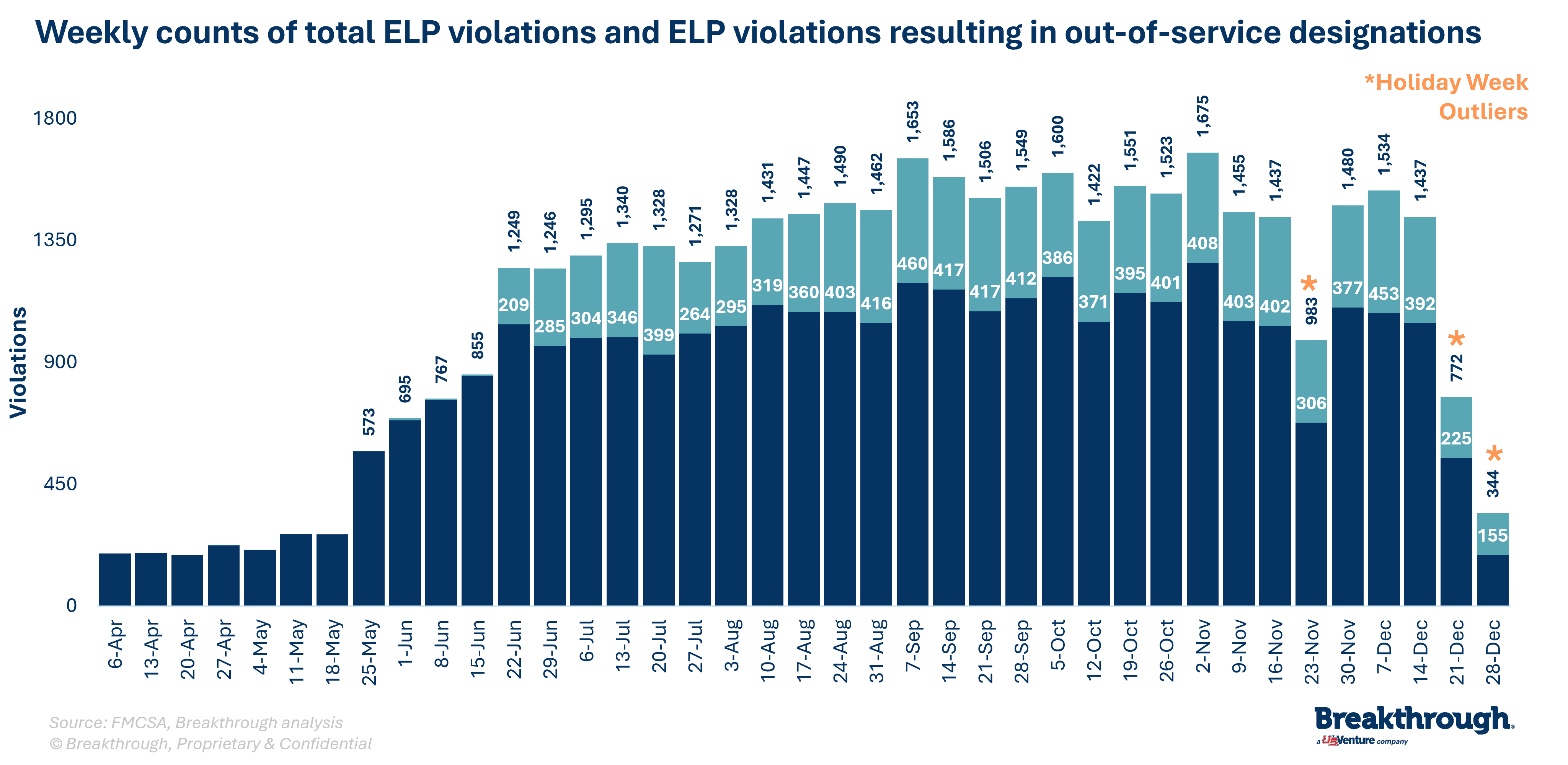

To understand the outcomes of this stricter enforcement, we analyzed FMCSA data from the second half of 2025. The findings show a consistent and impactful trend:

Weekly Violations: On average, regulators recorded about 1,600 English Language Proficiency violations each week.

Drivers Placed Out of Service: Of those weekly violations, approximately 400 resulted in the driver being immediately placed out of service.

Total Impact: Over the six-month period, this ramped-up enforcement led to an estimated 10,000 drivers being removed from the nation's capacity.

This reduction is a tangible loss of drivers that directly impacts the supply side of the supply-demand equation. For shippers, fewer available drivers means a more competitive and constrained market. Breakthrough’s Capac-ID solution is developed to help you contract competitive linehaul rates compared to the industry benchmark on each freight movement.

The removal of 10,000 drivers from the market through more stringent ELP enforcement contributed to a capacity experience that echoes past freight cycles. The capacity exit we observed in late 2025 is remarkably similar to the environment in the second half of 2019—a period characterized by a relatively weak freight market that preceded a major tightening of capacity.

This historical parallel, combined with the current data, informs our outlook for the coming year. We forecast gradual market tightening throughout 2026. As demand holds steady or increases against this smaller driver pool, shippers should prepare for:

Reduced Carrier Options: Fewer available drivers in certain geographies that will limit carrier availability, especially in high-demand lanes.

Modest Rate Pressure: With capacity tightening, we expect to see modest, yet consistent, upward pressure on linehaul rates.

These data-driven insights are crucial as your planning and executing your RFP and budgeting. By having access to a trusted transportation partner’s market expertise, you can proactively adjust your strategy to mitigate linehaul rate increases and ensure reliable capacity.

The stricter enforcement of English Language Proficiency regulations is a contributing factor toward future freight market conditions. Gradual capacity reductions, including the removal of roughly 10,000 drivers during the second half of 2025 from more stringent ELP enforcement, has set the stage for a gradually tightening freight market in 2026, which will likely bring modest rate increases.

To effectively navigate these market shifts, supply chain leaders require a real-time, shipper-transacted dataset to understand the actual linehaul rates being transacted on any given lane. Capac-ID provides this visibility. Discover how Capac-ID can empower your strategic decision-making and provide a competitive advantage for your network.

The English Language Proficiency (ELP) regulation for truck drivers was prompted from by an Executive Order signed in April 2025, which called for stricter enforcement. The FMCSA mandates commercial drivers must be able to understand and speak English sufficiently to handle their duties. This includes communicating with law enforcement, understanding road signs, and completing necessary paperwork.

The increase in ELP enforcement directly reduced freight capacity along the US-Mexico border. In the second half of 2025 alone, stricter enforcement resulted in approximately 10,000 drivers being placed out of service, shrinking compliant drivers, and tightening the market.

Given the reduction in driver capacity due to ELP enforcement and other market factors, we expect to see modest upward pressure on linehaul rates in 2026. The market will experience gradual tightening, making it more competitive for shippers.

Capac-ID

Access exclusive data on freight market dynamics and see the impact of English language proficiency enforcements on your network.

9 min read

March 6, 2026

Learn why natural gas, including CNG, LNG, and RNG, is a leading alternative to diesel and offers benefits like cost stability and lower emissions.

Read more

7 min read

March 5, 2026

Lower your fleet operating costs with fuel management best practices. Learn how benchmarking, strategic fuel purchasing, and operational insights can unlock significant savings.

Read more

9 min read

March 2, 2026

Escalating Middle East conflict is driving up crude oil and diesel prices. Learn how this geopolitical risk impacts fuel costs and how to manage the volatility.

Read more