2026 Freight Trends Report

Trending

Top Posts

5 min read

January 20, 2026

Share:

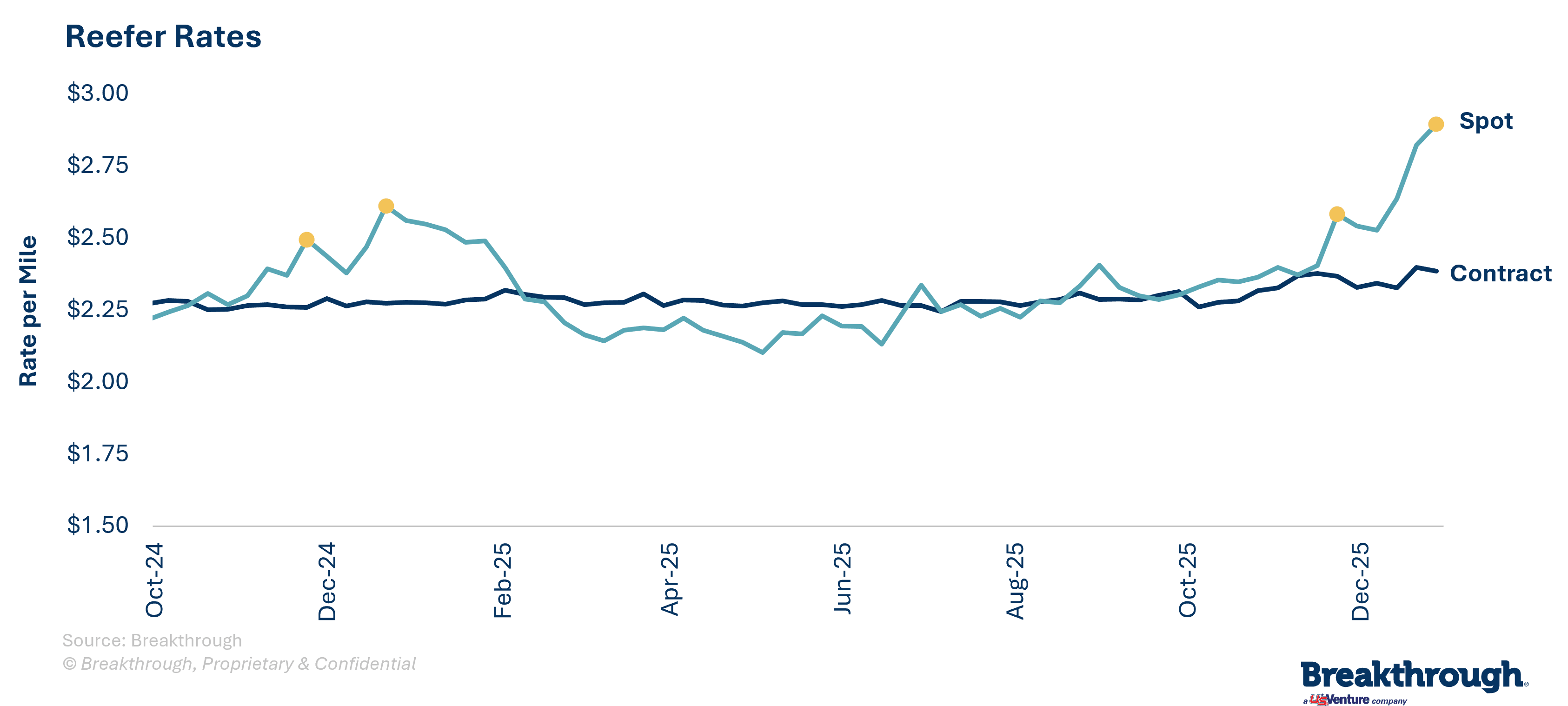

Shippers are experiencing fluctuating reefer rates and are questioning if this is a seasonal trend or the beginning of the market turning. The Breakthrough Ecosystem’s average reefer spot rate for December 2025 was $2.719 per mile, a more than 9% increase from 2024, while contract rates rose nearly 4% year-over-year to $2.362 per mile. The seasonal collision of weather and holiday-driven market dynamics likely explain much of this surge, but capacity has been tightening in the truckload market because of business cycle stress and more stringent policy leading to tightening capacity.

Uncertainty complicates budgeting and transportation strategies. By analyzing shipper-transacted freight data from the Breakthrough ecosystem of over $35 billion in annual transportation spend, we can provide clarity on the forces driving reefer rates and help you anticipate what's coming in 2026.

Volatility Insights: Recent volatility in reefer rates is primarily driven by seasonal factors, reflecting patterns observed in previous years.

Market Trend Analysis: Breakthrough's data shows that reefer rates, while elevated, may not yet suggest a cyclical turn for the market.

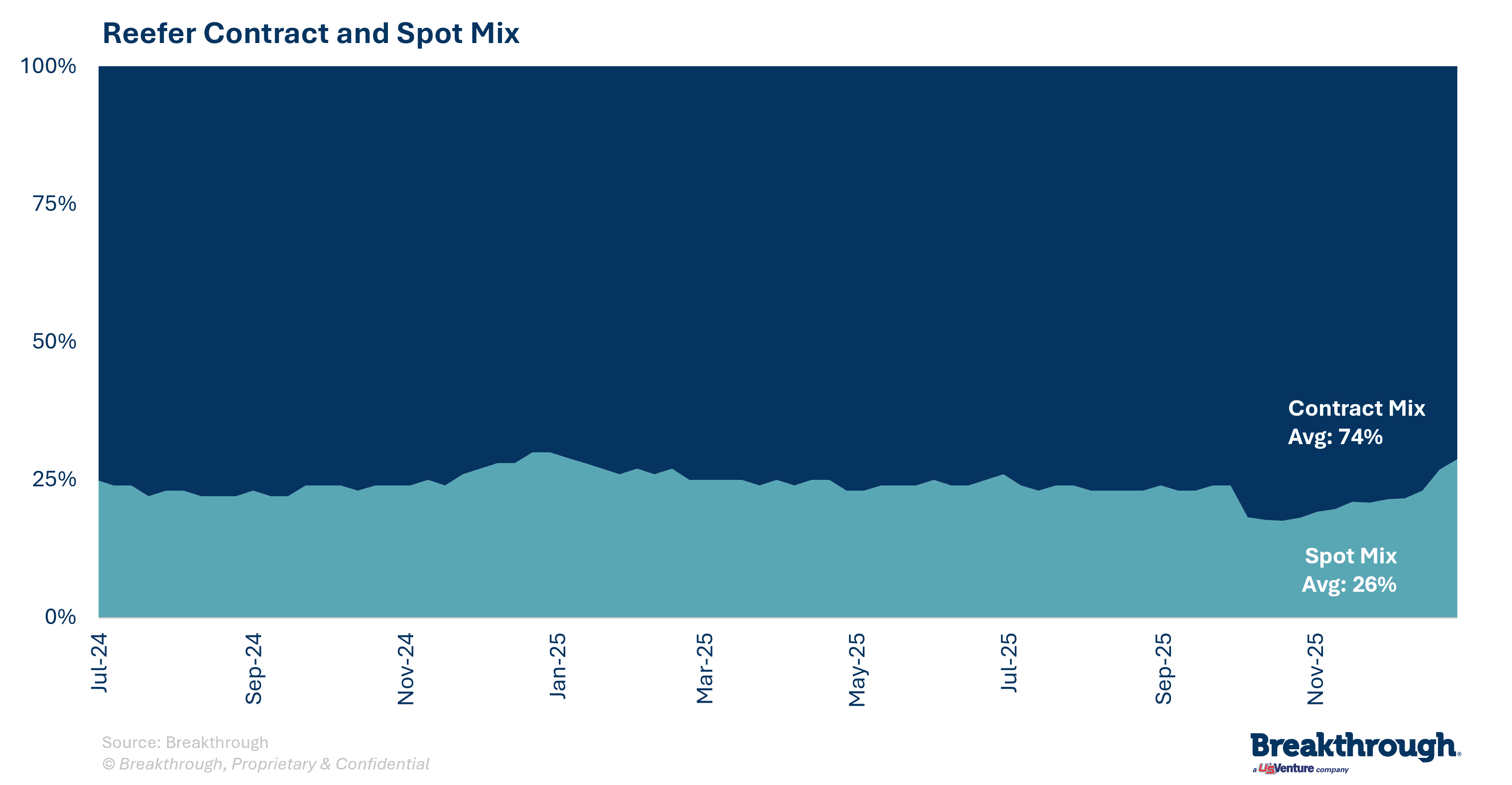

Freight Ratio Stability: The ratio of contract to spot rates remained steady up to December at an approximate 75/25 split, indicating market stability.

Future Monitoring: Shippers should monitor rate behavior through February 2026 for signs of a typical seasonal slide or early stabilization, which will signal future market direction.

Based on an analysis of transacted rates within the Breakthrough ecosystem, the current trend points toward a combination of seasonal patterns along with potential capacity and weather challenges adding pressure. When comparing 2025 data to 2024, we see a very similar seasonal experience, with spot rates showing a familiar upward trend ahead of the holidays.

While 2025 spot market moves were slightly higher than the previous year, suggesting some gradual capacity tightness, the overall pattern does not yet indicate a definitive market turn.

Several dynamic factors affect reefer rates, creating a complex pricing environment. Understanding them is key to understanding the inputs that impact your transportation management strategy.

Seasonality: The most predictable factor is harvest season. Produce harvests across different regions create surges in demand for temperature-controlled capacity, leading to rate peaks.

Capacity: The availability of refrigerated trailers and drivers directly impacts rates. Any tightness in capacity, whether from driver shortages because of English Language Proficiency standards or equipment constraints, puts upward pressure on pricing.

Demand: Beyond produce, consumer demand for perishable goods, especially around major holidays, drives significant volume and can cause spot rates to climb.

The ratio between contract and spot rates serves as a helpful barometer for market pressure. In the refrigerated sector, we have observed a consistent 75/25 split between contract and spot movements leading up to the holidays.

This stability suggests that, for the most part, shippers and carriers are honoring their contract agreements. A significant shift toward the spot market would signal that capacity is tightening, causing carriers to reject contract tenders in favor of more lucrative spot loads. Because this mix has remained steady, it reinforces the point that recent rate movements are seasonal rather than the start of a new cyclical trend.

To gain direction on the market in 2026, shippers should keep a close eye on reefer spot rate performance in the first quarter. Historically, the market experiences a "seasonal slide" following the holidays, with rates softening through the month of February.

Will that happen again in 2026? Or will rates stabilize sooner and find a floor before the end of the quarter? A typical seasonal slide would confirm the continuation of current trends, while an early stabilization or increase could be the first concrete sign of a market inflection that shippers need to prepare for.

The data from the past 2 years within the Breakthrough ecosystem indicates that the recent movements in reefer rates are a product of familiar seasonal trends, not a broader market inflection. The stability in the contract-to-spot mix further supports this conclusion. However, the freight market is cyclical.

Looking ahead, the key is to monitor real-time, shipper-transacted reefer linehaul rates through the first quarter of 2026. Because Breakthrough’s data is based on actual transactions rather than broad market sentiment, observing whether the typical post-holiday slide occurs—or if rates find an early floor—will provide the most accurate direction for the year.

Navigating this environment effectively requires precise, data-driven insights to optimize your network and manage transportation costs. This is where Capac-ID becomes essential. Capac-ID is a comprehensive productivity platform that provides shippers with a real-time view of linehaul rates and carriers that would be a good fit for your freight. By leveraging actual shipper-transacted data, it allows you to see what freight is actually moving at compared to promised rates and contract freight at fair, market-relevant rates. Whether you are seeking to secure reliable capacity during a market turn or reduce costs is a soft freight market, Capac-ID ensures your procurement strategy is aligned with the market.

Capac-ID

Understand how linehaul rates are shifting across the lanes in your transportation network.

6 min read

January 13, 2026

Explore the key drivers of the diesel market, from freight demand to refinery cycles, and learn how to manage price volatility with data-driven strategies.

Read more

9 min read

January 12, 2026

Discover modern fuel management solutions that provide transparency and cost control. Learn how to optimize reimbursements and reduce emissions in your network.

Read more

5 min read

January 7, 2026

Learn how to negotiate better fleet fuel discounts with proven strategies from industry-leading leaders. Optimize your fuel card program and leverage market insights to reduce costs.

Read more