2026 State of Transportation Report

Trending

Top Posts

5 min read

January 2, 2026

Share:

Table of contents

Browse the table of contents to jump straight to the part you’re looking for

Are you struggling to keep up with the biannual changes in diesel fuel taxes? These semi-annual adjustments in January and July can create significant budget variances and complicate transportation spend management.

Without timely and accurate data, even minor tax shifts across different states can lead to inaccurate fuel reimbursements and erode your profit margins. Integrating up-to-date information on state diesel fuel taxes directly into your carrier fuel reimbursement calculations is crucial. By leveraging precise diesel fuel tax by state data, organizations can have more transparent conversations with carriers and ensure your fuel cost strategies remain both effective and fair.

Diesel fuel taxes change semi-annually, typically in January and July.

Diesel fuel tax by state fluctuations directly influence freight costs and your overall transportation spend.

These tax changes can accumulate significantly across a freight network if they are not accounted for accurately in your fuel management program.

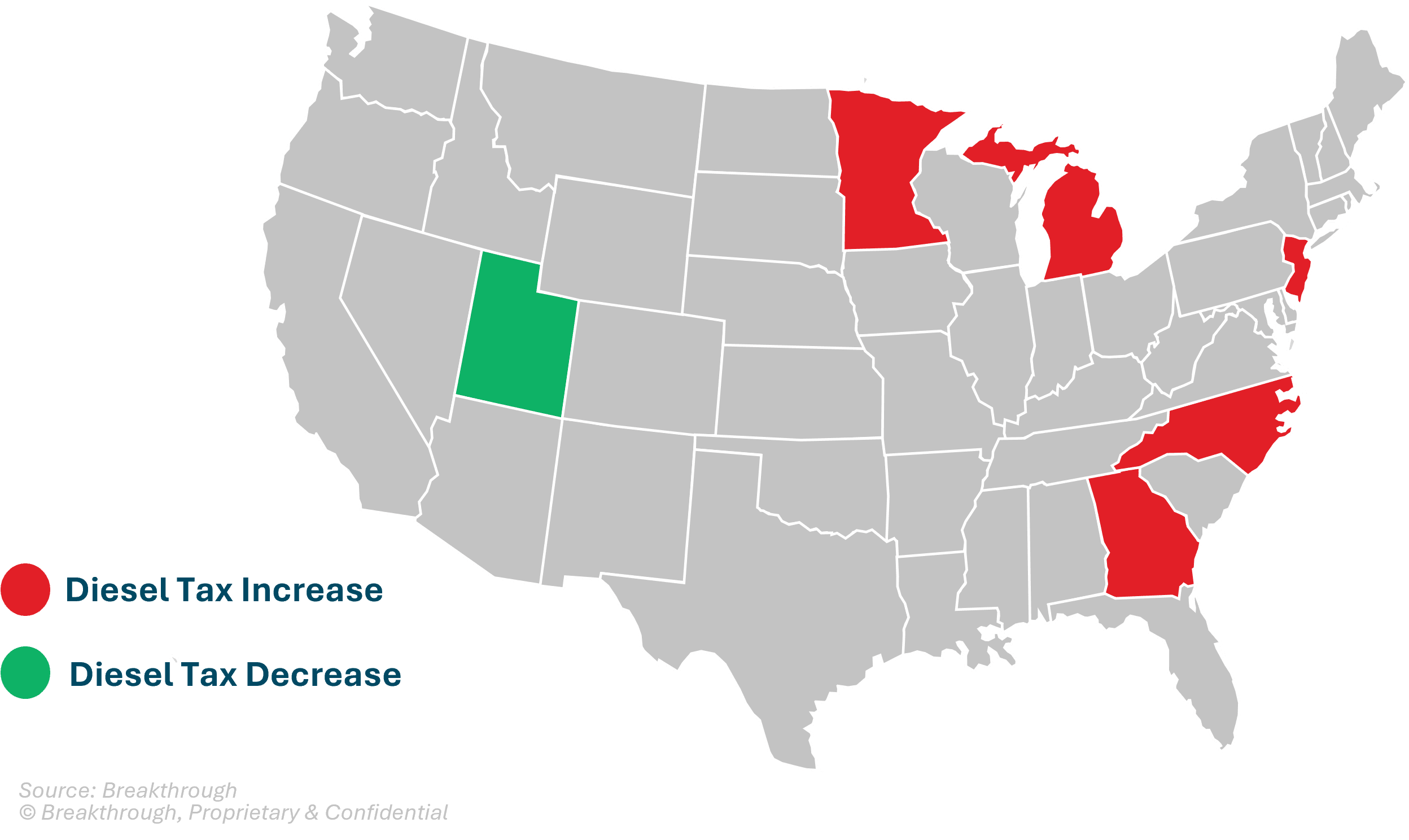

As of January 2026, several states have implemented adjustments to their diesel fuel tax rates. These changes, while seemingly small on a per-gallon basis, have a direct impact on transportation costs and the operational budgets of shippers and carriers. Below is a list of states with notable changes.

| State | New Tax | Change from Prior |

| Georgia | 37.3¢ | +0.2¢ |

| Michigan | 52.4¢ | +1.7¢ |

| Minnesota | 32.6¢ | +0.8¢ |

| New Jersey | 56.1¢ | +4.2¢ |

| North Carolina | 41.0¢ | +0.8¢ |

| Utah | 37.9¢ | -0.6¢ |

A few states will introduce notable tax hikes, reflecting efforts to maintain consistent revenue streams for infrastructure needs:

Michigan: Diesel excise tax increased by 1.7 cents, rising to 52.4 cents per gallon. The state recently restructured its excise tax and sales tax for fuels to eliminate the sales tax and build everything into the excise tax. This will ensure all fuels taxes are available only for highway infrastructure investments and will not be diverted elsewhere.

New Jersey: A 4.2 cent increase in the excise tax, combined with the Motor Fuels Tax, raised diesel taxes to a combined 56.1 cents per gallon. This change is part of a multi-year ramp up in fuel taxes to support the New Jersey Highway Trust Fund for critical infrastructure upgrades.

Many states use automatic adjustment mechanisms to ensure their diesel fuel tax by state keeps pace with economic conditions. This practice helps sustain long-term funding for transportation projects, but adds a layer of complexity for shippers and carriers. Common methods include:

Taxes based on a percentage of fuel prices: Rates fluctuate with the wholesale or retail price of diesel.

Flat excise taxes: These are fixed per-gallon charges on diesel fuel, regardless of fluctuations in fuel prices.

Inflation-driven calculations: A base rate is adjusted periodically based on an inflation index like the Consumer Price Index (CPI).

These systems are designed to maintain the purchasing power of infrastructure funds. However, they also introduce variability that can challenge traditional fuel surcharge programs and make accurate cost forecasting difficult.

For shippers and carriers, staying informed about diesel fuel tax adjustments is crucial for effective budget management and operational planning. These changes directly influence freight costs, making it essential to proactively adapt strategies for transportation fuel cost reduction.

Ignoring these details can lead to over or under-reimbursing carriers for fuel, which distorts the true cost of transportation fuel spend. A market-based fuel reimbursement program provides the necessary precision to navigate this complex landscape. By calculating reimbursements based on the specific time, tax, price, and geography of each freight movement, you can ensure fairness and accuracy.

If you want to eliminate manual tracking and ensure your fuel cost strategies remain both accurate and effective, it’s time to consider Fuel Recovery.

In the first quarter of 2026, Georgia, Michigan, Minnesota, New Jersey, and North Carolina all increased their diesel fuel tax rates. Michigan and New Jersey saw the most significant hikes, with increases of 1.7 cents and 4.2 cents per gallon, respectively.

States adjust diesel fuel taxes primarily to fund transportation infrastructure projects, including the construction and maintenance of roads, highways, and bridges. Many states use automatic adjustment formulas tied to inflation or fuel prices to ensure revenue keeps pace with rising costs and economic changes.

The most effective way to manage the impact is to use a market-based fuel reimbursement program. Unlike traditional DOE-based surcharges, this approach accounts for the exact taxes, price, and location of each fuel purchase. This ensures reimbursements are accurate and reflect the true cost of fuel, protecting your budget from unforeseen variances.

Fuel Recovery

Get the diesel fuel tax by state data you need to accurately reimburse for fuel.

5 min read

February 13, 2026

Explore the key factors driving the price of diesel, from refining premiums to global supply, and why these prices differ from crude oil costs.

Read more

6 min read

February 12, 2026

Discover actionable strategies to improve fleet fuel efficiency, reduce transportation costs, and achieve sustainability goals. Learn how data-driven insights can transform your MPG calculations and fuel reimbursement programs.

Read more

5 min read

February 11, 2026

Extreme winter weather can disrupt refinery operations, impacting refinery margins and diesel prices. Learn how these factors affect your fuel costs.

Read more