2026 State of Transportation Report

Trending

Top Posts

Sustainability

How to Develop Cost-Effective Sustainable Transportation Strategies

7 min read

February 20, 2026

Transportation Strategy

A Shipper’s Guide to the European Union Emissions Trading System II

6 min read

February 19, 2026

Market Events

Connect with Breakthrough at These Spring 2026 Events

4 min read

February 18, 2026

6 min read

November 20, 2025

Share:

Table of contents

Browse the table of contents to jump straight to the part you’re looking for

Diesel markets are currently experiencing significant price swings. On Tuesday, U.S. diesel futures surged more than 15¢ per gallon, marking the highest close since April 2024. On Wednesday, trading showed a slight reversal, with prices decreasing by 6.5¢ per gallon. This volatility is a direct consequence of escalating geopolitical events, specifically the recent increase in Ukraine drone strike activity targeting Russian energy infrastructure. For transportation leaders, understanding the connection between these events and your fuel costs is critical for protecting your bottom line.

In recent weeks, Ukraine has escalated its drone attacks on Russian energy infrastructure. With nine confirmed strikes in November alone, these strikes have forced major refineries—including Novokuibyshevsk (170k b/d), Ryazan (340k b/d), and Saratov (140k b/d)—to reduce or halt operations.

This has a direct impact on supply. Russia’s crude-processing rates have already dropped by 200,000 barrels per day (b/d), and with the full effect of recent attacks yet to be reflected in official data, further declines are expected. This reduction in refined fuel output sends ripples across the globe, directly pushing prices upward.

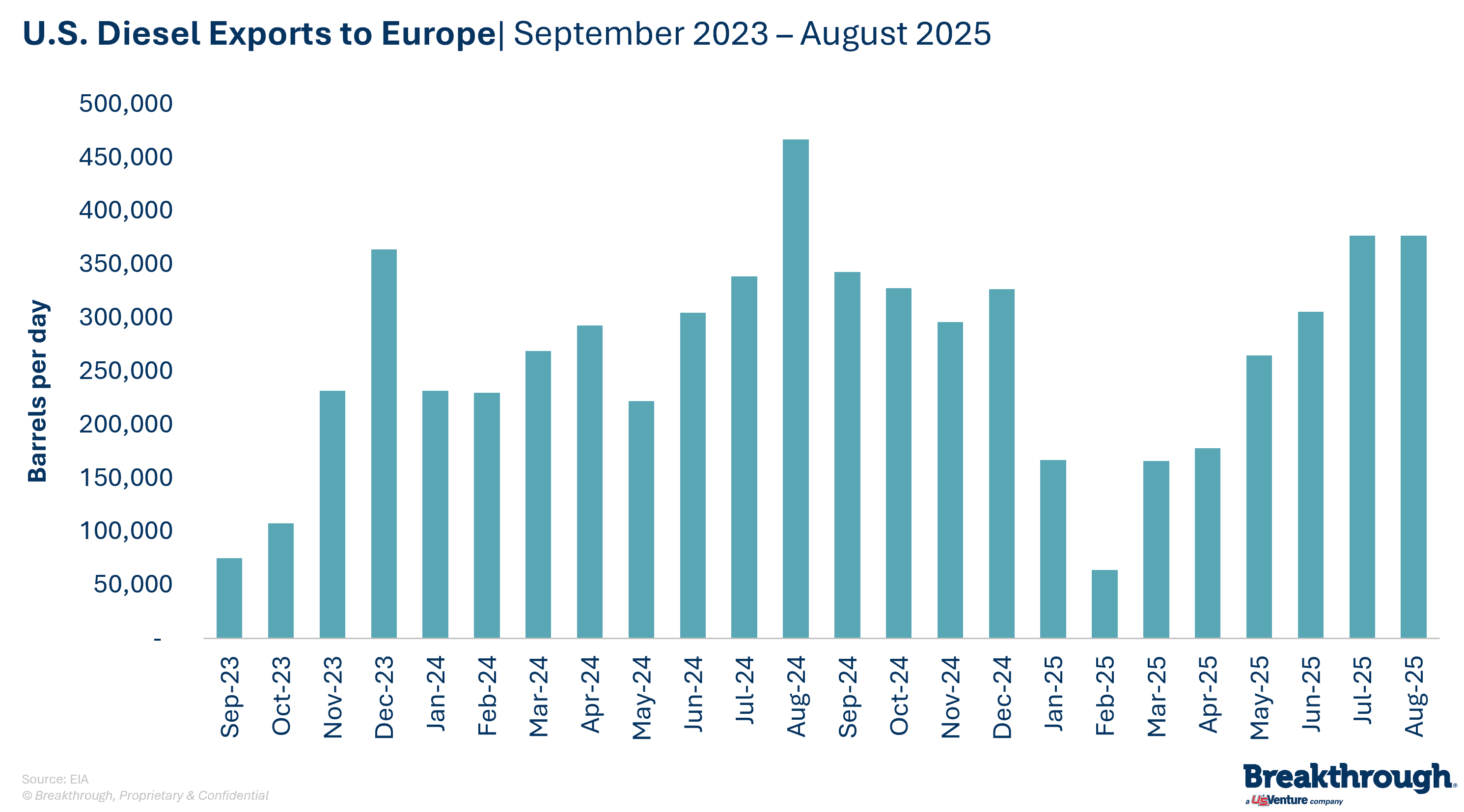

European distillate inventories remain tight amid strong winter heating demand, pulling barrels eastward and supporting U.S. export economics. EIA data shows U.S. distillate exports to Europe are on par with last year’s highs for this period.

A common question is how diesel prices can surge when crude oil, which accounts for about half of diesel's cost, is globally abundant. But geopolitical risks and sanctions are creating a disconnect: ample crude supply does not translate to refined product availability, and that imbalance is keeping diesel prices elevated.

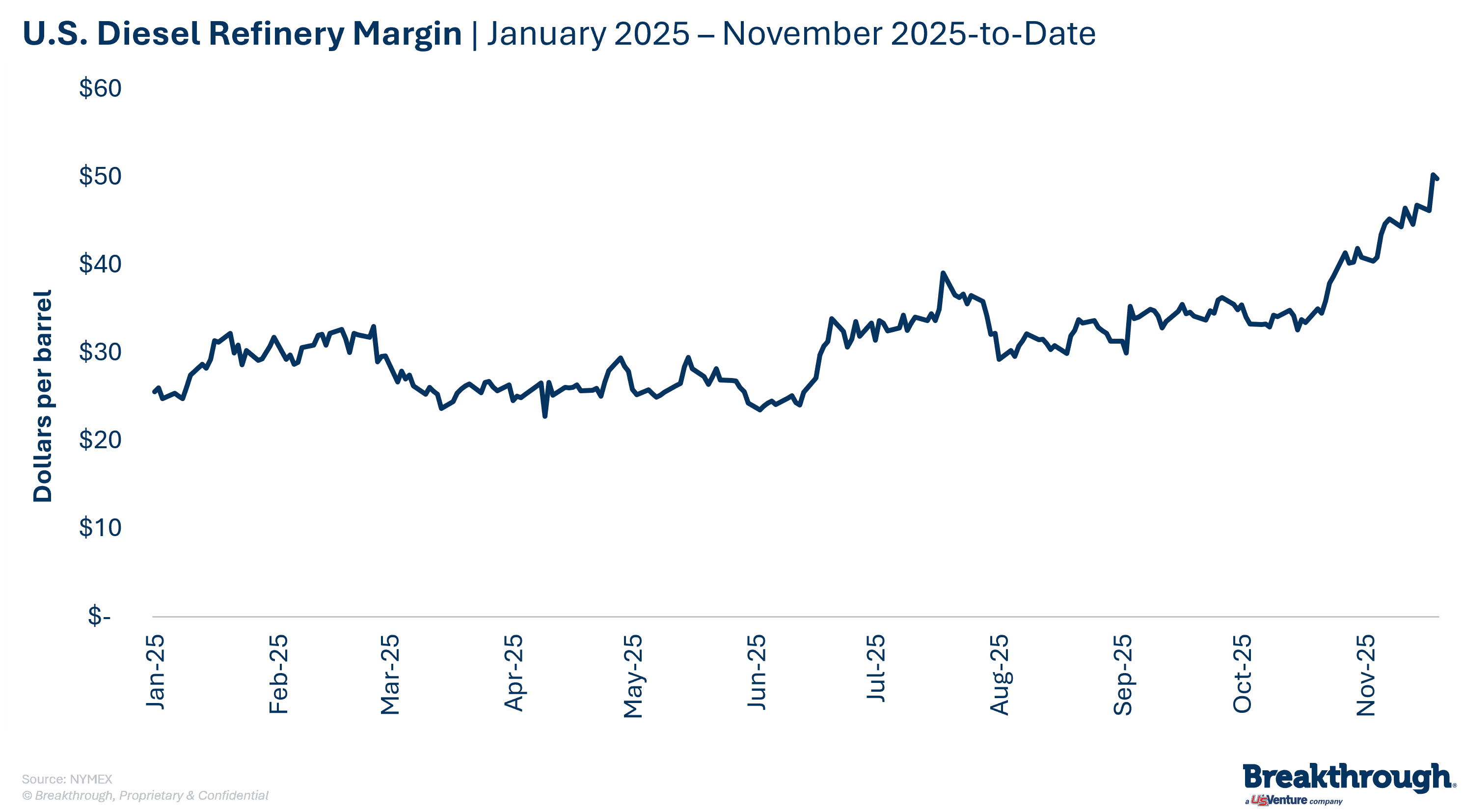

The Ukraine drone strikes and accompanying sanctions create this dynamic. Ukraine is targeting the refineries that turn crude oil into fuel. This creates a disconnect where crude prices may remain stable or even fall, while diesel prices climb due to a shortage of refining capacity and finished product. This is reflected in surging refinery margins, which are now at levels not seen since September 2023.

Reports suggest the White House may unveil a peace framework with Russia as early as this week, potentially ending the three-and-a-half-year war in Ukraine. While details remain unclear, even the possibility of a deal has introduced risk-off sentiment, tempering the bullish tone from recent supply disruptions.

In the past, price spikes driven by geopolitical tensions were often short-lived, disappearing once the immediate risk subsided. This time is different. The ongoing attacks are removing physical fuel and infrastructure from the supply chain, and sanctions are tightening refined product flows.

For shippers, this means the premium for refined products like diesel will likely have staying power in the market, keeping prices elevated well beyond the typical risk window. This creates significant challenges for budget forecasting and threatens profit margins for any organization with exposure to fuel price volatility. Proactive strategies are essential to mitigate the financial impact of this new market reality.

In the current landscape marked by persistent volatility and supply chain disruptions, securing transportation budgets is challenging. Breakthrough’s T-Fuel® solution empowers shippers to lock in fuel prices for the fuel consumed while moving products to market, delivering much-needed stability. By leveraging T-Fuel, you turn unpredictable fuel expenses into a managed, predictable cost, directly supporting profitability, long-term planning, and resilience against market swings.

Through 11/18, diesel prices increased by about 16% during the past 30 days. This represents the most significant price pressure thus far into 2025 and exceeded our forecast expectations. We will continue to assess market fundamentals and the political risk environment ahead of our December forecast. We expect to increase our near-term diesel forecast prices because of these dynamics. We continue to expect crude oil prices will decrease through Q1 2026 and counter some of the upward price pressure that diesel is experiencing. We release our latest diesel forecast on the second business day of each month.

The drone strikes force Russian refineries to reduce or stop production, which decreases the global supply of refined diesel. Limited diesel supply and steady demand, particularly in Europe, drive prices up. This creates price volatility and elevates fuel costs for shippers worldwide.

While crude oil is the underlying commodity responsible from which diesel is produced, it must be processed in a refinery. The current attacks are specifically targeting refineries, creating a bottleneck in production. Even with abundant and cheaper crude oil, the limited capacity to refine it into diesel tightens the finished product supply, causing diesel prices to rise independently of crude.

A high refinery margin (the difference between the cost of crude oil and the price of a refined product like diesel) indicates that the refined product is in high demand and/or tight supply. The current margins of over $50 per barrel signal that the market is paying a significant premium for diesel due to supply constraints caused by refinery disruptions.

T-Fuel

Take control of volatile fuel costs and stabilize your transportation spend.

7 min read

February 20, 2026

Explore practical sustainable transportation strategies that reduce emissions and costs. Learn how to balance sustainability goals with operational efficiency.

Read more

6 min read

February 19, 2026

Understand the upcoming European Union Emissions Trading System II. Learn how new carbon pricing will impact road transport diesel costs and how to prepare your strategy.

Read more

4 min read

February 18, 2026

Join Breakthrough at industry events this spring. Meet with our experts to learn how you can cut costs and decarbonize your network.

Read more