2026 State of Transportation Report

Trending

Top Posts

3 min read

July 31, 2025

Share:

Table of contents

Browse the table of contents to jump straight to the part you’re looking for

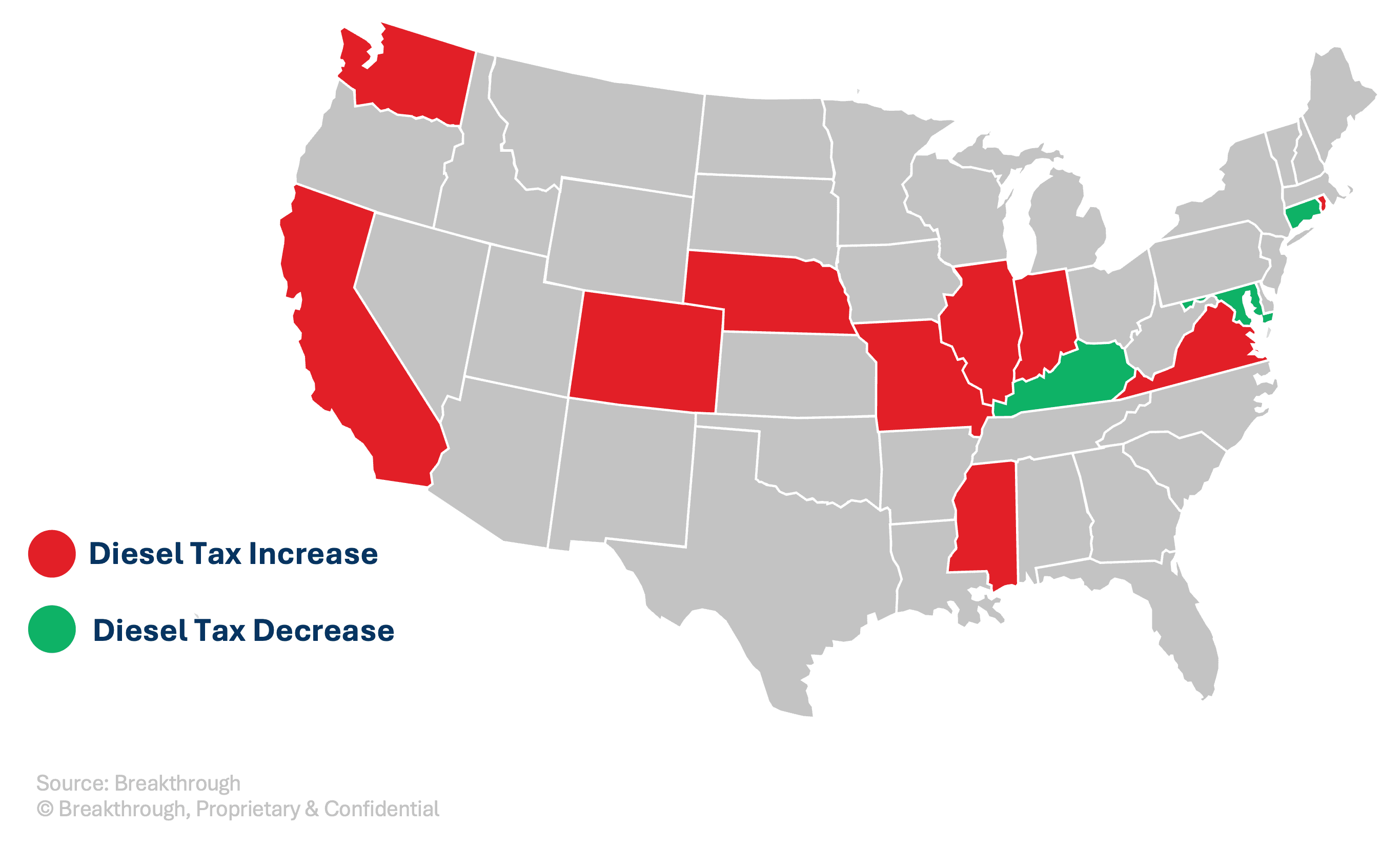

State budgets often drive mid-year and new-year tax adjustments, making January and July key months for diesel tax updates. This July, 13 states introduced notable adjustments. In this blog, we highlight the diesel fuel tax per state that directly impact transportation costs and industry operations.

Several states introduced tax hikes, reflecting efforts to maintain consistent revenue streams for infrastructure needs:

When we look at state taxes, there may be a difference between the diesel fuel tax rate and the International Fuel Tax Agreement (IFTA) fuel tax rate. For instance, in California, the state’s diesel fuel tax increased by 1.2 cents to 46.6 cents, but its component b, which is the second component of its IFTA tax rate, decreased by 6.4 cents to 50.5 cents, resulting in an overall lower IFTA diesel tax value of 97.1 cents.

Many states employ automatic adjustment mechanisms, often tied to inflation or fuel prices, to keep diesel fuel tax rates aligned with economic conditions. These methods include:

These systems allow states to sustain long-term funding for infrastructure and transportation projects, ensuring smoother operations and maintenance. However, they also present challenges for shippers and carriers managing fluctuating transportation costs.

For shippers and carriers, staying informed about diesel fuel tax per state adjustments is critical to managing budgets and optimizing operations. These changes can directly influence freight costs, making it essential to proactively adapt strategies for fuel efficiency and cost management.

If you’re looking to understand how these adjustments affect your business and are interested in tailored solutions to optimize your transportation network, contact us! Breakthrough’s market-based fuel reimbursement solution, Fuel Recovery, calculates your exact reimbursement based on the time, tax, price, and geography of your individual freight movements.

5 min read

February 13, 2026

Explore the key factors driving the price of diesel, from refining premiums to global supply, and why these prices differ from crude oil costs.

Read more

6 min read

February 12, 2026

Discover actionable strategies to improve fleet fuel efficiency, reduce transportation costs, and achieve sustainability goals. Learn how data-driven insights can transform your MPG calculations and fuel reimbursement programs.

Read more

5 min read

February 11, 2026

Extreme winter weather can disrupt refinery operations, impacting refinery margins and diesel prices. Learn how these factors affect your fuel costs.

Read more